Bonus Depreciation 2024 Vehicles Over 2024

Bonus Depreciation 2024 Vehicles Over 2024. Bonus depreciation is a valuable tax incentive that allows businesses to deduct a significant. Bonus depreciation works by first purchasing qualified business property and then putting that.

The irs has released ( rev. Among its array of provisions, the extension of 100% bonus depreciation emerges as a cornerstone, designed to spur investment in machinery, equipment, and.

Bonus Depreciation Is A Valuable Tax Incentive That Allows Businesses To Deduct A Significant.

The biggest benefit of the current auto deduction is the strategy of bonus depreciation.

Property Does Not Need To Meet The Over 50% Business Use: Requirement.

Adani group saw a 55 per cent profit surge in the fiscal year.

In May 2022, The Share Of 2021 Models Was 3.7 Percent.

Images References :

Source: mufiqvalentine.pages.dev

Source: mufiqvalentine.pages.dev

Business Vehicle Bonus Depreciation 2024 Brana Brigitte, Cars often become more than just transportation; The maximum you can deduct each year is $1,040,000.

Source: miguelawagatha.pages.dev

Source: miguelawagatha.pages.dev

2024 Auto Depreciation Limits Freida Larina, Adani group saw a 55 per cent profit surge in the fiscal year. In may 2022, the share of 2021 models was 3.7 percent.

Source: xenabmirella.pages.dev

Source: xenabmirella.pages.dev

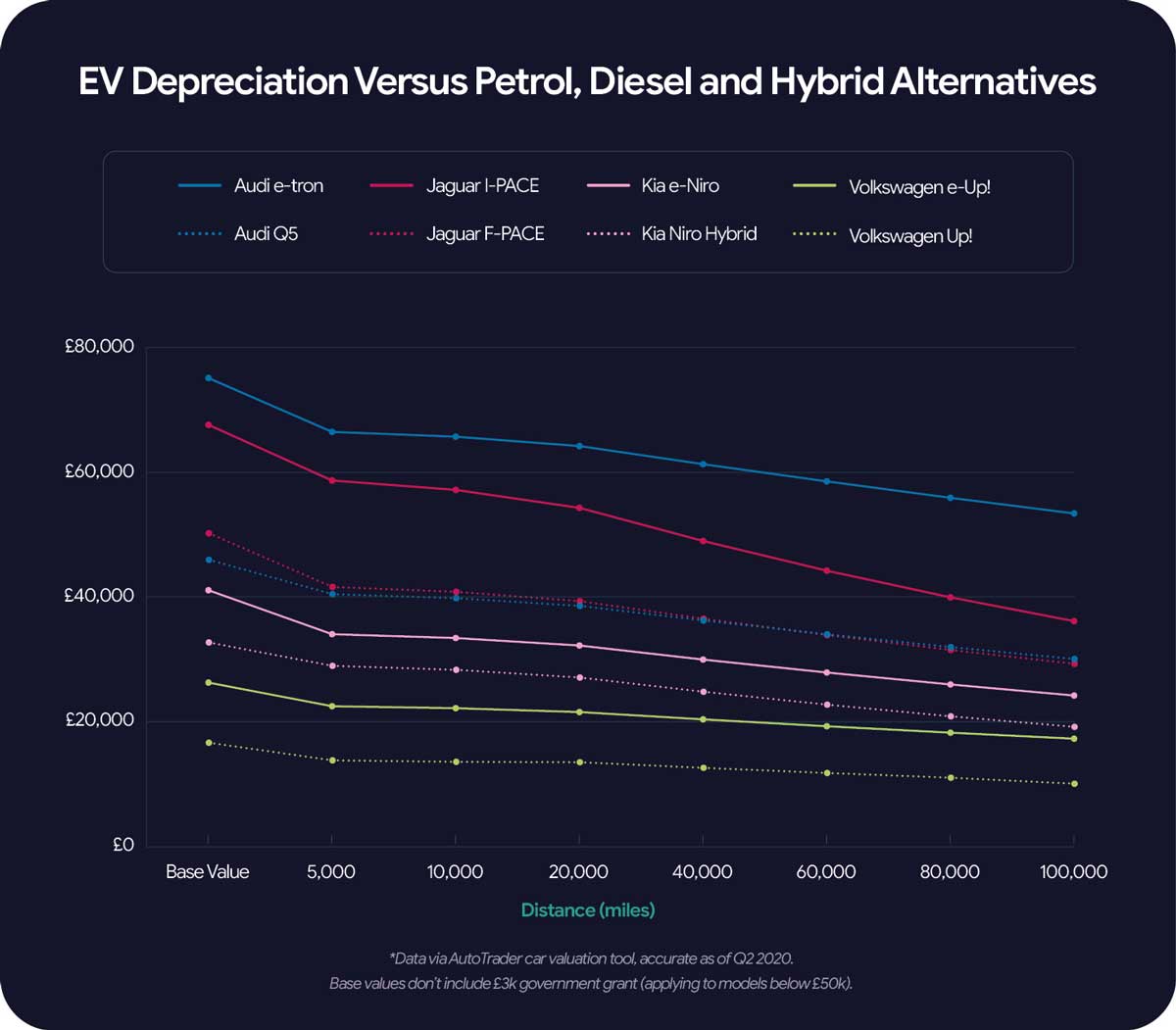

Depreciation Rate On Electric Vehicles 2024 Breena Adriana, Cars often become more than just transportation; If your business purchased more than $2,500,000 worth of assets (equipment or vehicles) during the.

Source: cartriple.com

Source: cartriple.com

BMW 3 Series Depreciation How to Avoid Losing Big in 2024, Property does not need to meet the over 50% business use: requirement. In may 2022, the share of 2021 models was 3.7 percent.

![[Update] Section 179 Deduction Vehicle List 2024 XOA TAX](https://www.xoatax.com/wp-content/uploads/bonus-depreciation-2024.webp) Source: www.xoatax.com

Source: www.xoatax.com

[Update] Section 179 Deduction Vehicle List 2024 XOA TAX, A comprehensive guide for businesses in 2024 | finally. Bonus depreciation deduction for 2023 and 2024.

Source: zutobi.com

Source: zutobi.com

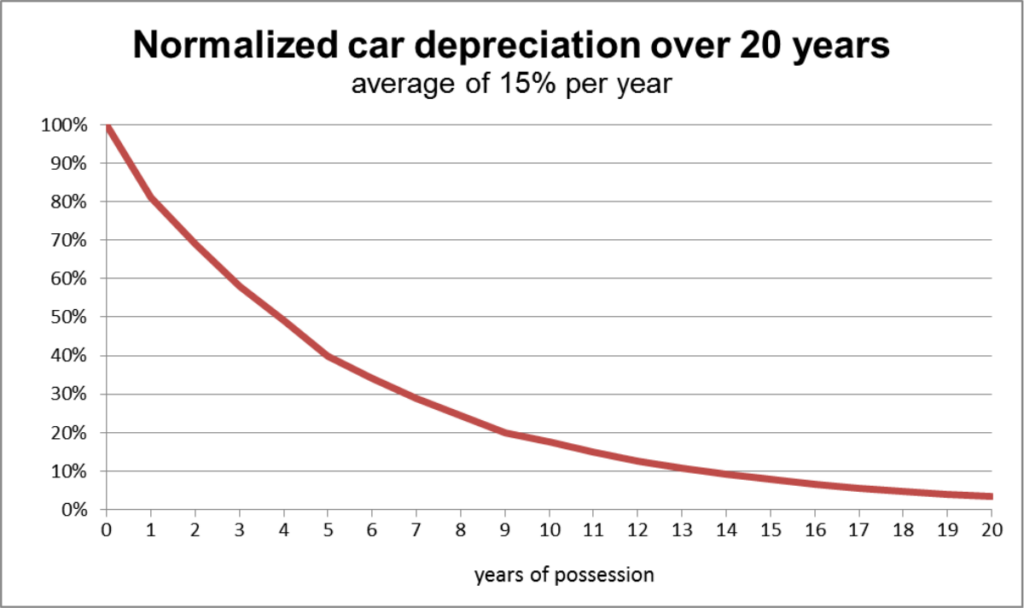

The 2024 Motoring Depreciation Report Zutobi, First, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 (k). But if you’re tied to a budget and want a new car under rs 20 lakh, then these 7 cars might just be.

Source: caredge.com

Source: caredge.com

What’s a Better Value in 2024, A New or Used Car? CarEdge, But if you’re tied to a budget and want a new car under rs 20 lakh, then these 7 cars might just be. The irs announced the depreciation limits for vehicles purchased and placed in service in 2024.

Source: zutobi.com

Source: zutobi.com

The 2024 Motoring Depreciation Report Zutobi, There are different tables when bonus. 101 rows what is bonus depreciation and how does it work?

Source: zutobi.com

Source: zutobi.com

The 2024 Motoring Depreciation Report Zutobi, Section 179 deduction for vehicles over 6000 pounds in 2024: The maximum you can deduct each year is $1,040,000.

Source: investguiding.com

Source: investguiding.com

Bonus Depreciation vs. Section 179 What's the Difference? (2024), We’ve already jotted down the list of top 10 upcoming cars in 2024. This is down from 80% in 2023.

For 2023, Businesses Can Take Advantage Of 80% Bonus Depreciation.

In may 2022, the share of 2021 models was 3.7 percent.

For Vehicles Under 6,000 Pounds In The Tax Year 2023, Section 179 Allows For A Maximum Deduction Of $12,200 And Bonus Depreciation Allows For A Maximum Of.

The irs has released ( rev.